Analysis of RASFF Food Contact Material Notification System for the First Quarter of 2018

The Rapid Alert System for Food and Feed(RASFF)is a key tool which secures the flow of information necessary for a swift reaction when risks to public health are detected in the food chain. RASFF notifications usually report on risks identified in food, feed or food contact materials that are placed on the market in the notifying country or detained at the border. The RASFF food contact material notification analysis report gives a deeper insight into its performance during the first quarter of 2018.

There are 31 RASFF notifications available on food contact materials for the first quarter of 2018. The following section will analyze the RASFF notifications in connection with the notifying country, notifying product, notifying subject and the notified country, offering suggestions on available countermeasures.

1. Notifying country

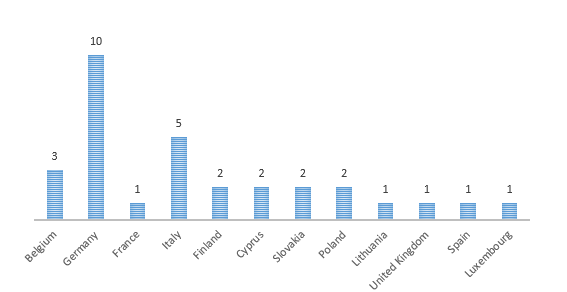

Figure 1 shows Germany as the country with the highest amount of notifications in the last three months, followed by Italy and Belgium, which explains why exporters should pay more attention to FCM regulations in these three countries in order to take countermeasures.

Figure 1 Notifying country in the first quarter

2. Notifying product and Notifying subject

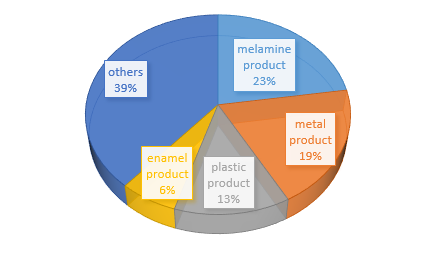

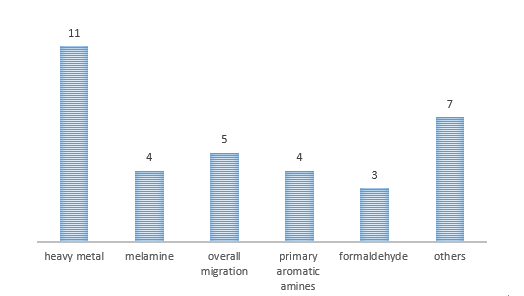

As shown in Figure 2, during the first quarter or 2018 melamine products, metal products and plastics were predominately notified, accounting for 55% of the total. Figure 3 shows in more detail how the main hazards for notifications were the migration of heavy metals and melamine from products, and the overall high level of migration. This warns exporters that compliance with the restrictions in the FCM regulatory system in EU and supervision of the products quality is of extreme relevance.

Figure 2 Notifying product in the first quarter

Figure 3 Notifying subject in the first quarter

3. Notified country

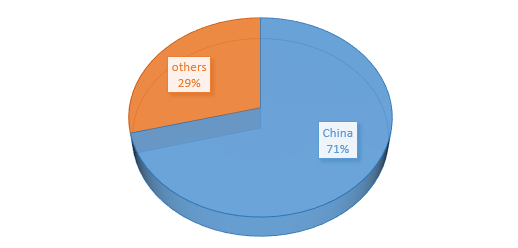

It is worth noting that the most notified products came from China, as shown in Figure 4, with a total of 71% unqualified products of Chinese origin. Chinese enterprises should focus more on improving their production technology and follow changes in European import policies to ensure trade is run smoothly.

Figure 4 Notified country in the first quarter

4. Suggestions on the countermeasures

As a first step, enterprises should strengthen their tracking of food contact material regulations, including amendments and redresses in EU, focusing on the regulatory differences that may exist in different countries. Secondly, it is recommended that exporters increase the level of investment in technology, regularly improve their quality management and assurance system and standard processing technology. Finally, while they consolidate their presence in the EU market, enterprises could also actively explore emerging markets, seek new partners, implement diversified strategies on existing trading partners and seek ways to overcome food contact technology trade barriers in developed countries.